richmond property tax calculator

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The median property tax in Richmond County.

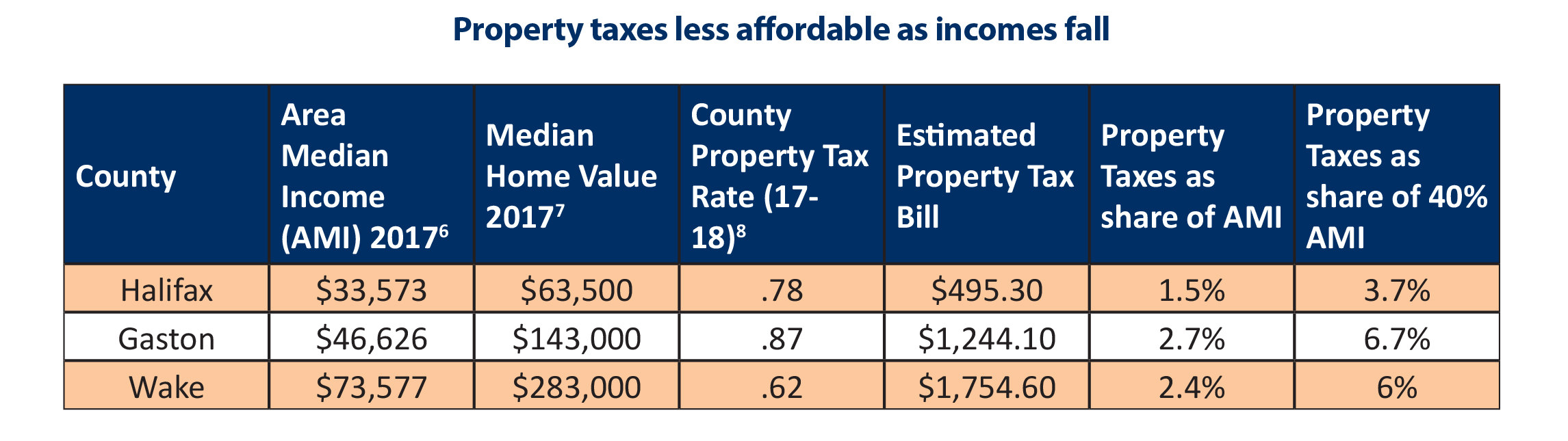

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Richmond County.

. Richmond County calculates the property tax due based on the fair market value of the home or property in question as determined by the Richmond County Property Tax Assessor. See How Much You Can Afford With a VA Loan. For comparison the median home value in Richmond County is.

RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. The New York City Registers Office collects this tax for all boroughs except for.

0810 of Assessed Home Value. Box 4277 Houston TX 77210-4277. 1020 of Assessed Home Value.

For comparison the median home value in Richmond County is. Please note property taxes can only be paid at the tag offices via debit card credit card or check For more information call 706-821-2391. Along with collections property taxation involves two additional general steps.

Taxing units include Richmond county. If you cannot find your assessment notice property owners can visit wwwmpacca and select the Property Owners option at the top menu bar then click on AboutMyPropertyTM or call Access. Submit Tax Payments PO.

Property Taxes Due 2021 property tax. Formulating real estate tax rates and conducting appraisals. Mailing Contact Information.

The City Assessor determines the FMV of over 70000 real property parcels each year. Reserved for the county however are appraising property issuing billings taking in collections carrying. Richmond City collects on average 105 of a propertys assessed.

Under the state Code reexaminations must occur at least once within a three-year timeframe. These documents are provided in Adobe Acrobat PDF format for printing. General Correspondence 1317 Eugene Heimann Circle Richmond TX 77469-3623.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. A 10 yearly tax hike is the maximum raise allowed on the capped properties. 1110 of Assessed Home Value.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. A tax is charged when mortgages for property in New York City are recorded. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

While observing legal restraints mandated by statute New Richmond enacts tax rates. The population of Richmond Hill increased by 36 from 2016 to 2021. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

For comparison the median home value in Richmond County is. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Richmond Hill real estate prices have increased by 45 from June 2021 to JUne 2022 with the average sold price of a.

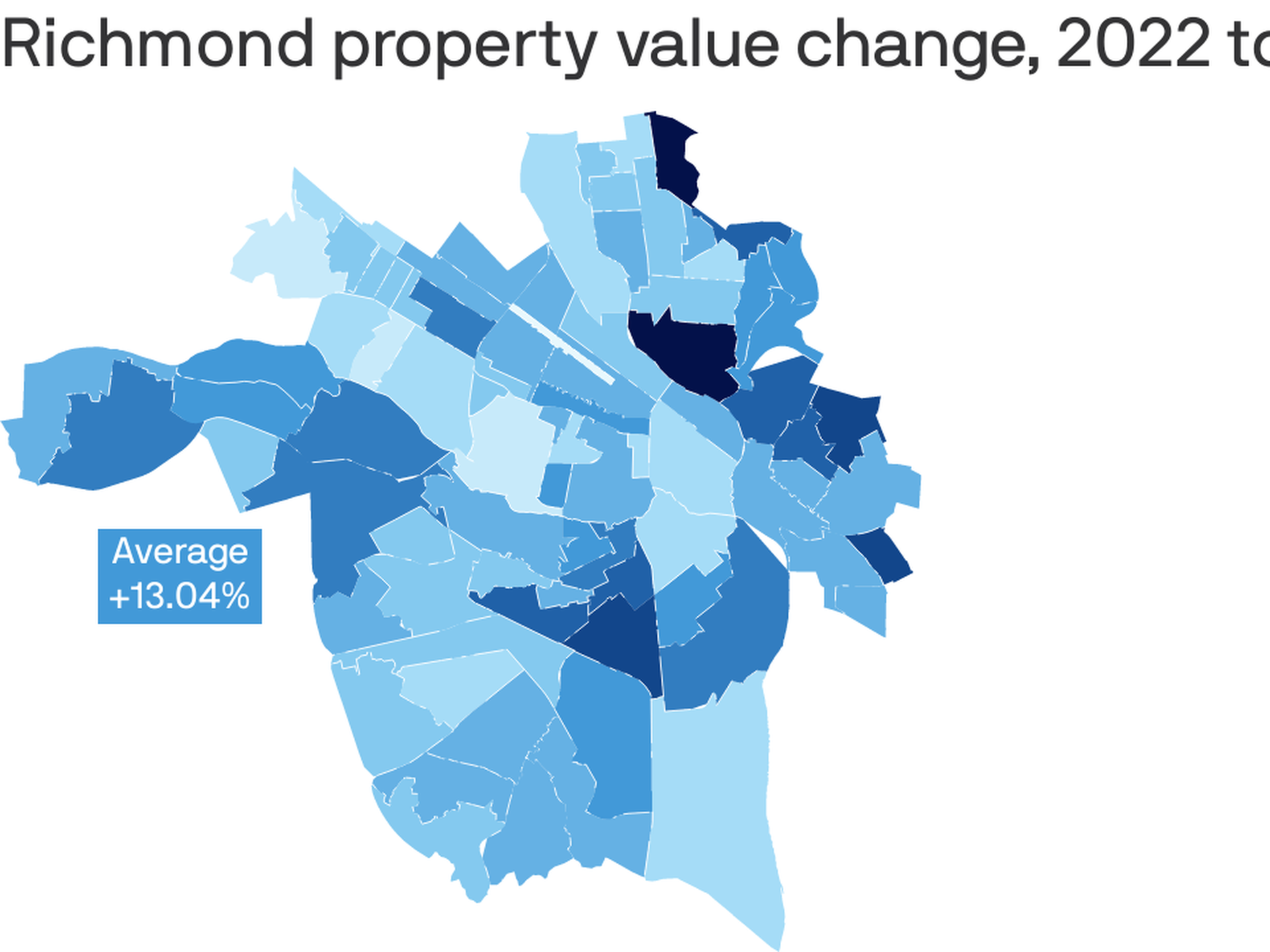

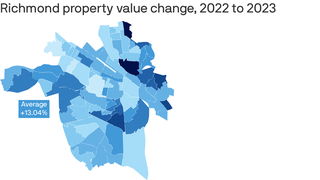

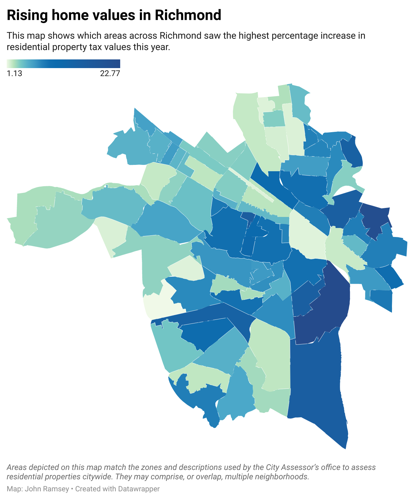

Where Richmond Property Values Went Up Most Axios Richmond

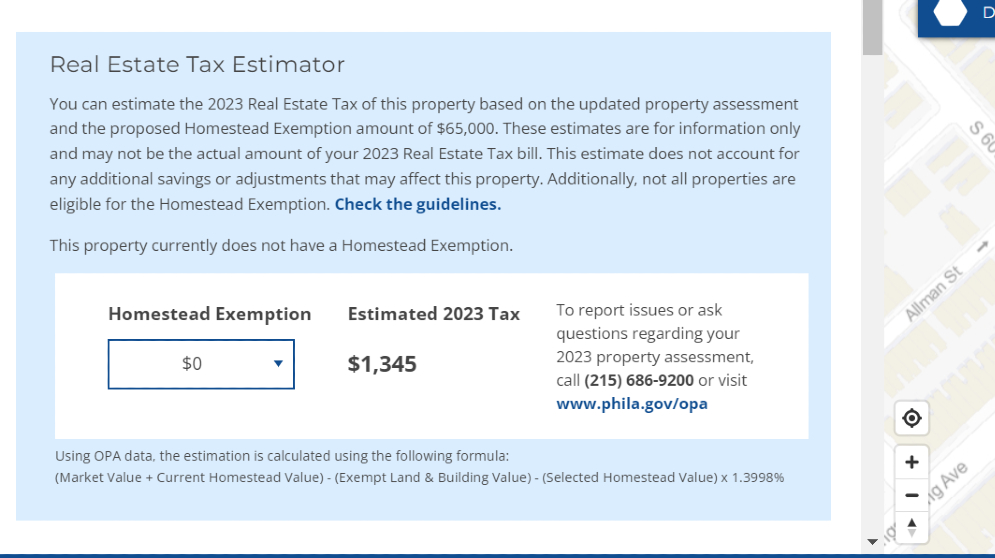

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

About Your Tax Bill City Of Richmond Hill

Polk Has One Of Lowest Property Tax Rates The Tryon Daily Bulletin The Tryon Daily Bulletin

Real Estate Basic Facts Per Subdivisions Within Richmond Tx 77407

Property Tax By County Property Tax Calculator Rethority

Yes Tiverton S Property Taxes Are High Tiverton Fact Check

Where Richmond Property Values Went Up Most Axios Richmond

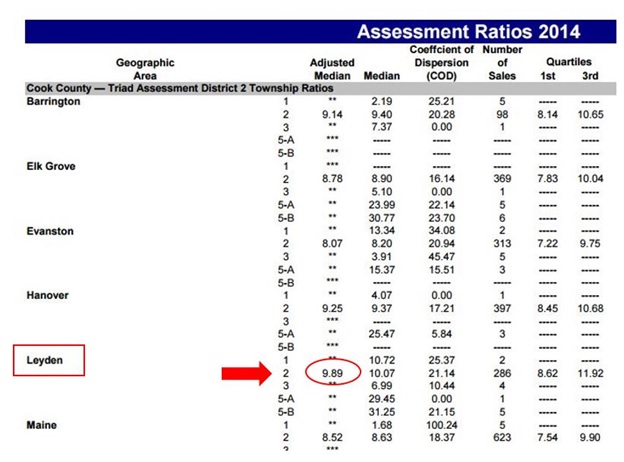

Calculate Your Community S Effective Property Tax Rate The Civic Federation

Where Richmond Property Values Went Up Most Axios Richmond

Property Tax By County Property Tax Calculator Rethority

Augusta Metro Area Property Taxes Below U S Average But Richmond County Is Right On The Line

Your Richmond Virginia Real Estate Questions Answered

A Comparison Of Property Tax Rates 2 Viewpoint Vancouver

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

City Council To Consider Real Estate Tax Rate Richmond Free Press Serving The African American Community In Richmond Va